This week, BankTrack launched their latest report on the top coal-financing banks in the world. The ranking, topped by JPMorgan Chase and Citigroup, includes several other U.S. banks in the top 20 based on their total financing for coal mining and coal-fired power since 2005.

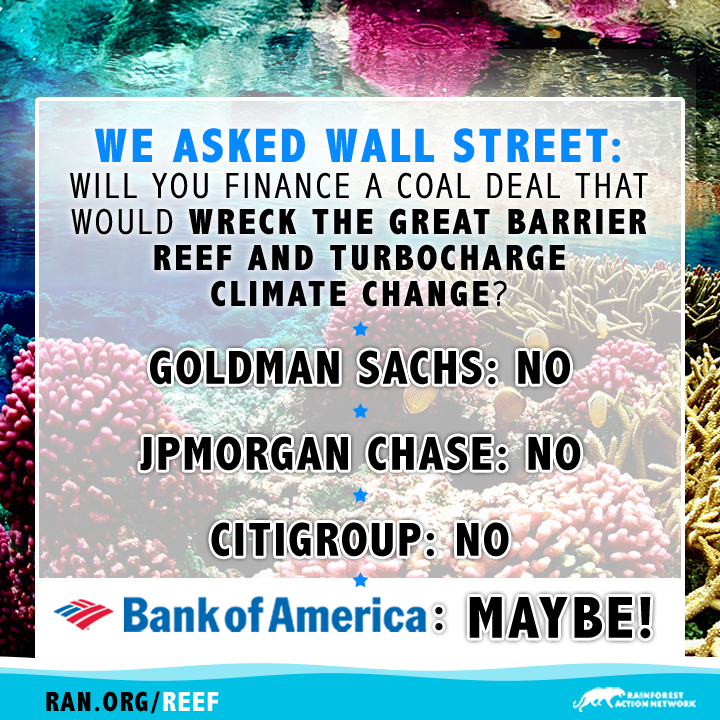

As the piece we’ve cross-posted below notes, it’s telling that even the top financiers of coal in the world have decided to stay away the proposed coal terminal expansion at Abbot Point on the Great Barrier Reef. But unfortunately, even though most of their competitors have concluded that expanding Abbot Point would be a disaster for the climate and the reef, Bank of America still hasn’t gotten the message.

By Ben Collins (RAN), Yann Louvel (BankTrack) and Julien Vincent (Market Forces), cross-posted from RenewEconomy:

The proposed expansion of the Abbot Point coal export terminal is running out of friends in the banking world. This week’s news that U.S. giants Citigroup, Goldman Sachs, and JPMorgan Chase will not finance the proposed coal export terminals at Abbot Point bring the total number of banks to have made this commitment to nine. Even Morgan Stanley, currently in business with Adani over the partial sale of the existing coal export terminal at Abbot Point, acknowledge the environmental risks associated with the proposed new terminals and won’t provide funding to expand the coal port.

And a new report from global banking watchdog BankTrack underlines the significance of these commitments.

The report lists the top twenty global banks in terms of their investments in the coal industry over the past decade. Leading the list are JPMorgan Chase, Citigroup, the Royal Bank of Scotland and Barclays, having financed the global coal industry to the tune of US$105 billion since 2005.

However, these major coal-funding banks are also doing something good.

They have all signalled that they are not going to fund the proposed expansion of the Abbot Point coal port, the focal point for exports out of what would be a series of new mega coal mines proposed in Queensland’s Galilee Basin.

It says a lot about the unacceptability of the proposals to build two massive new coal export terminals in the Great Barrier Reef World Heritage Area that banks with the strongest record of financing the sector have all opted out. In fact, six of the top ten and nine of the top twenty coal funding banks have now stated that they don’t plan to fund the expansion of Abbot Point, although holdouts such as U.S.-based Bank of America have so far refused to state their position on financing Abbot Point.

Despite poor market conditions, high costs and the massive outpouring of concern over the environmental impacts of their projects, Indian companies GVK and Adani remain hell-bent on opening up the Galilee Basin in Queensland. When we say “mega” coal mines, we really mean it. The smallest is as large as Australia’s biggest operating coal mine and the largest, twice the size. All of the proposals in the Galilee Basin would produce enough coal to chew up 7% of the world’s remaining carbon budget, drastically reducing our chances of keeping a lid on global warming.

Adding insult to environmental injury, the coal would be shipped out through new coal export terminals to be built in the Great Barrier Reef World Heritage Area, turning the region into a coal shipping superhighway. All for the sake of feeding the world dirty and expensive fuel when renewable energy options are already more economically viable.

The more international banks acknowledge that building coal ports in the Great Barrier Reef to massive expand exports is a bridge too far, the sharper it brings Australia’s “big four” banks into focus.

A report last week from the Institute for Energy Economics and Financial Analysis confirmed that if the Galilee Basin mega mines are going to go ahead, they would need the support of the likes of ANZ, Commonwealth Bank, NAB and Westpac. Historically, these banks have loaned the most money and taken part in far more fossil fuel deals than any other bank, so their importance to financing the new mega mines and coal export terminals in the Reef is obvious.

So far, the banks have been coy about saying anything about the proposals to expand coal exports through the Great Barrier Reef, falling back on sustainability policies that have, in recent years, seen them lend nearly $20 billion to fossil fuels. It has created an absurd situation where banks headquartered in Paris, London, and New York are doing more to stand up and defend the Reef than Australian banks.

It is already costing the banks. Several thousand customers have so far joined the rapidly growing divestment movement, moving to other banks in protest of the big four’s massive lending to the fossil fuel industry. And thousands more, worth hundreds of millions of dollars, sit in waiting, ready to shift their business based on whether the Australian banks will stand up and defend the Reef or fund its demise.