Spotlight on the Government Pension Investment Fund of Japan

Achieving a sustainable, climate-safe future is estimated to require an additional $2~3 trillion per year over the next 15 years. Pension funds worldwide manage an estimated $30 trillion in combined assets. If we’re to save the planet for future generations, successfully mobilizing this capital is key.

On July 3rd, the world’s largest pension fund, the Government Pension Investment Fund of Japan (GPIF), announced a set of indices for its so-called “ESG” investments. Shockingly, the indices include companies—notably major Japanese banks—that are at the forefront of financing the destruction of the planet. Managing 1.3 trillion USD in assets, GPIF decisions like this can have a major impact on capital flow and perceptions of which companies are “responsible.” This recent decision calls into question the GPIF’s commitment to responsible investing.

The GPIF’s ESG portfolio

In September 2015, the GPIF signed the UN-backed Principles for Responsible Investment (PRI) and pledged to incorporate Environmental, Social, and Governance (ESG) issues into how it manages its investments. ESG is shorthand for how investors identify socially and environmentally responsible companies. The GPIF has been a vocal proponent for long-term investing that takes into account ESG factors, including climate risk. Last year, the GPIF’s Executive Managing Director and Chief Investment officer Hiromichi Mizuno publicly remarked, “Climate change is a long-term issue but we need to take it into our daily investment practice. ESG indices/positive screen companies is one way to do that.”

At the same time, he called on asset managers to commit to shifting their investments away from dirty infrastructure: “Asset owners as a community, who agree to responsible investment principles, have to make a statement that we are not going to finance those type of infrastructure, regardless of the commercial viability or commercial feasibility or whatever attractiveness on the cost basis.”

This month, the Fund started to allocate 1 trillion yen ($8.8bn) of its portfolio to three indices, as part of its bigger plan to allocate a total of 3 trillion yen ($26.7bn) to shares with strong ESG characteristics. The Fund selected the following three indices, all newly launched.

GPIF’s ESG picks are fueling climate destruction

Unfortunately, a closer look at the selected indices reveals a number of problematic companies, including the top three banks in Japan:

-

Mizuho Financial Group

-

Mitsubishi UFJ Financial Group

-

Sumitomo Mitsui Financial Group

Research by Rainforest Action Network (RAN) and several partners reveals that these three banks are, as we speak, pumping billions of dollars into the two most significant contributors to climate change: extreme fossil fuels and tropical deforestation.

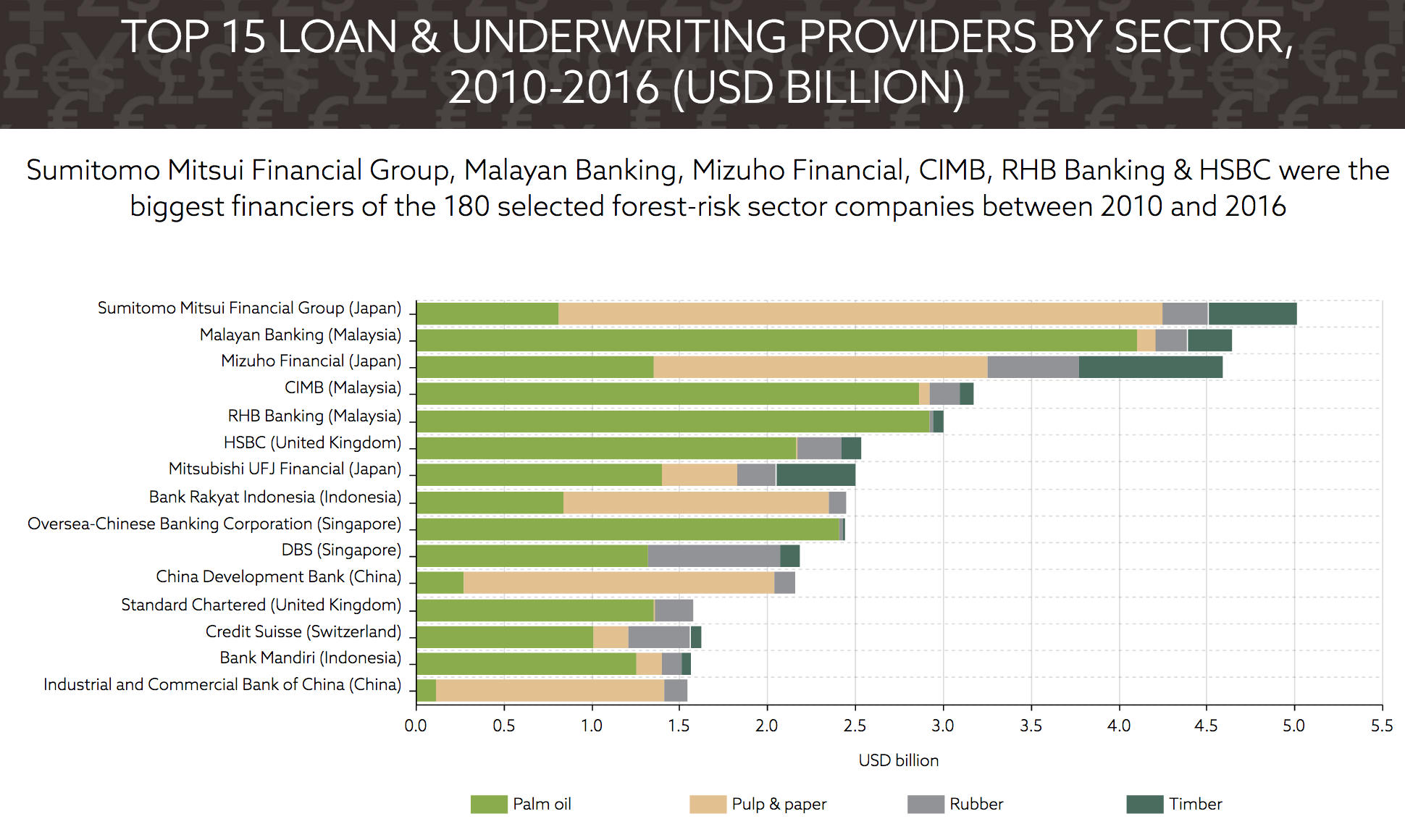

An initiative by RAN, TuK-Indonesia and Profundo, called forestsandfinance.org, tracks down the banks and investors that are financing rainforest destruction in Southeast Asia. By analyzing some of the worst companies operating in the palm oil, pulp & paper, timber, and rubber (“forest-risk commodities”) sectors of Southeast Asia, we found the top three Japanese banks are among their biggest financial backers:

-

Between 2010-2016, Sumitomo Mitsui Financial, Mizuho, and Mitsubishi UFJ, allocated 12 billion USD in corporate loans and underwriting to forest-risk commodity operations in Southeast Asia (See Figure below).

-

The majority of their financing went to the palm oil and pulp & paper sectors, which are the leading drivers of tropical forest loss in Southeast Asia and major drivers of climate change through their conversion of carbon-rich peatlands.

Japanese banks are also major financiers of some of the most carbon-intensive sectors of the fossil fuel industry: extreme oil (tar sands, Arctic, and ultra-deepwater oil), coal mining, coal-fired power, and liquefied natural gas (LNG) export. This year’s Fossil Fuel Finance Report Card, “Banking on Climate Change” published by RAN, BankTrack, Sierra Club and Oil Change International, found Japanese banks are heavily exposed to these sectors.

- Between 2014-2016, Mitsubishi UFJ, Mizuho, and Sumitomo Mitsui Financial allocated more than 20 billion USD to extreme fossil fuel extraction or related infrastructure by just 158 companies profiled in the report.

- In 2016, Mitsubishi UFJ and Mizuho increased their financing for coal power—the most carbon-intensive source of power generation—by a combined total of nearly 2 billion USD, in stark opposition to Paris Climate Agreement goals.

- All three banks financed the construction of the controversial Dakota Access Pipeline in the United States and are currently financing the development of the Canadian Tar Sands, which has been called the biggest carbon bomb on the planet.

Canadian Tar Sands development devastates the Earth

PHOTO: Louis Helbig / beautifuldestruction.ca

What can be done?

As the largest shareholder of all three Japanese banks, the GPIF bears the largest responsibility in ensuring these banks are financing a low-carbon future. To its credit, the GPIF has asked its external asset managers to integrate ESG into its investment processes, but much more needs to be done.

Improve Disclosure: As a first step, the GPIF and other investors should urge the top three Japanese banks to assess and disclose all significant ESG risks across their entire financing portfolios, with a priority on carbon-intensive sectors including fossil fuels and tropical forest-risk commodities. Our analysis found that none of these banks properly disclose their ESG risks to investors. Investors should also urge reform of Japan’s Corporate Governance Code so companies are required to disclose all climate and human rights-related risks. Reporting should be consistent with the GRI Sustainability Reporting Guidelines, Recommendations of the Task Force on Climate-related Financial Disclosures, and the Guiding Principles on Business and Human Rights.

Improve Due Diligence: Investors should urge banks they invest in to adopt policies and due diligence systems for all sectors that pose significant climate, biodiversity and human rights risks. Unlike banks in the US and Europe, none of the top Japanese banks have comprehensive policies to minimize the harmful impacts of their financing. The Japanese banks should publicly commit to protect valuable High Carbon Stock forests and peatlands, respect human rights, and end financing of coal mining, coal power, and extreme oil and gas.

Divest: Investors should divest if the banks fail to take prompt action to clean up their financing.

While G20 world leaders (absent the US) just reaffirmed their commitment to the Paris Climate Agreement, the Paris goal of keeping temperature rise to “well below 2ºC” won’t be achievable if banks and investors continue to pump money into high-carbon assets. Having included some of the world’s biggest financiers of climate change into its new ESG indices, the GPIF has the responsibility to ensure these banks change their practices to support a low-carbon economy.