**This blog has been updated as of November 2020**

Blockades, water protector camps, and protests at the governor’s residence and public hearings have spotlighted what is at stake: the Line 3 pipeline runs roughshod over Indigenous rights and threatens our shared climate by expanding access to dirty tar sands oil. Despite fierce opposition, construction is complete in Wisconsin and Canada. In Minnesota, pipeline company Enbridge secured key state and federal permits in November 2020 and intends to begin construction imminently. This is despite the project continuing to face key hurdles, including one government agency suing another over the project, a global pandemic, and the promise of massive resistance.

While Enbridge continues to push the project forward, other actors are supporting the pipeline behind the scenes: big banks.

Enbridge has billions of dollars in loans provided by dozens of big banks that it can use for its “general corporate purposes.” These credit facilities, as they’re called, are like giant credit cards for Enbridge to use as it pleases. And as research shows, the credit facilities provide Enbridge with crucial liquidity, or access to cash, including for the funds which regulators require pipeline companies to have on hand in the event of an oil spill.

Enbridge has not sought project-specific financing for the Line 3 pipeline; its banks are facilitating other ways to access the money needed to build the project. It’s raised funds by selling off unwanted parts of its business — including some of its renewable energy assets — and by issuing new bonds, which banks buy from the company and then resell to investors.

From underwriting, to advising, to lending, the Line 3 tar sands pipeline would not happen without the support of Enbridge’s banks. “Without the direct financing and services provided by its bankers, Enbridge would have little choice but to abandon its plans to expand the Line 3 pipeline,” concludes the Sightline Institute research.

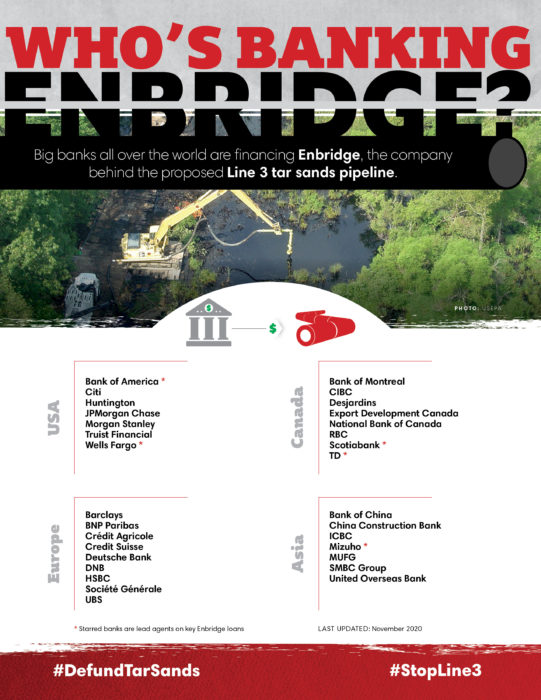

So who are these banks?

All of the banks listed on this graphic are lenders to one or more credit facilities to relevant Enbridge companies. The five starred banks — Bank of America, Wells Fargo, Scotiabank, TD, and Mizuho — are lead agents on those loans.

Some of these banks have supported Enbridge and Line 3 by underwriting the company’s bond issuances. Income from certain bond sales is a critical source of funding for Enbridge’s spending plan, which includes its massive Line 3 project. Bank of America, Bank of Montreal, Barclays, CIBC, Citi, Credit Suisse, JPMorgan Chase, Mizuho, MUFG, Scotiabank, and SMBC Group have all been lead managers in underwriting the bonds Enbridge issued in 2020.

In addition, some banks on this list are raking in fees for advising Enbridge on how to sell off certain assets in order to focus more on pipelines like Line 3. Citi, CIBC, and RBC have all helped Enbridge sell off natural gas and renewable assets since May 2018.

Banks’ support of Enbridge continues a legacy of climate damages and abuses of Indigenous rights. They have a choice: they can step away from this high-risk project by not renewing Enbridge’s $12+ billion in credit facilities when they come to maturity, with an initial opportunity to cut ties as soon as March 2021. They can walk away from Line 3, from Enbridge, and from expansion of the tar sands at large. Wall Street lenders and international banks can refuse to profit from climate disaster and join a collective global effort to build a thriving future.

Where not hyperlinked, financial information is from Bloomberg Finance L.P.