The data is in: the latest issue of our flagship annual report, Banking on Climate Chaos, is hot off the press and reveals this year’s roundup of the worst fossil fuel financiers. Luckily for these finance giants, we’ve provided a clear roadmap on what’s needed of them to pull us back from the brink of climate catastrophe—and we know the pressure points to make sure our voices are heard.

Chase is still the Bank of Doom, and Citi is close behind. MUFG deserves a dishonorable mention.

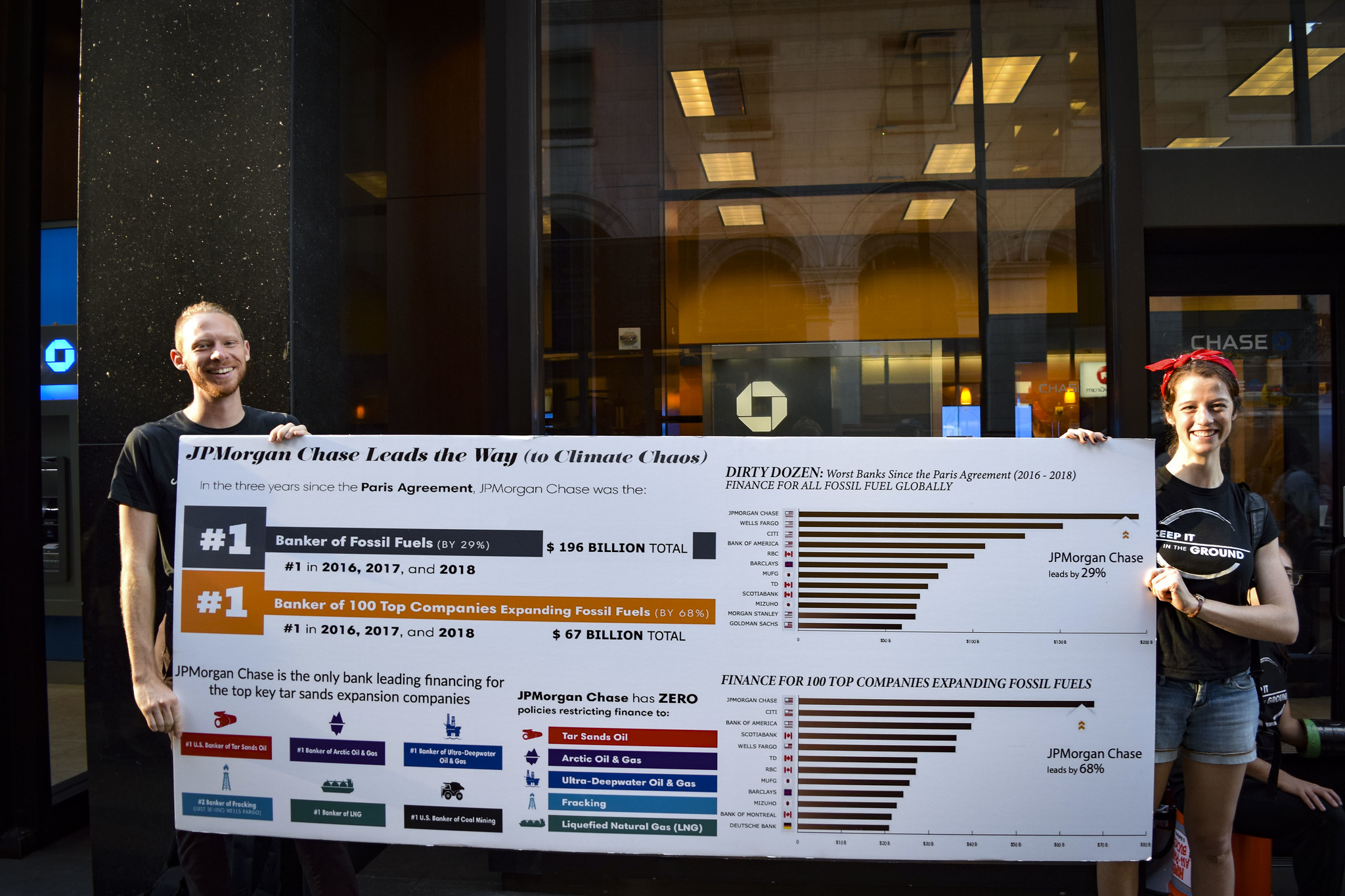

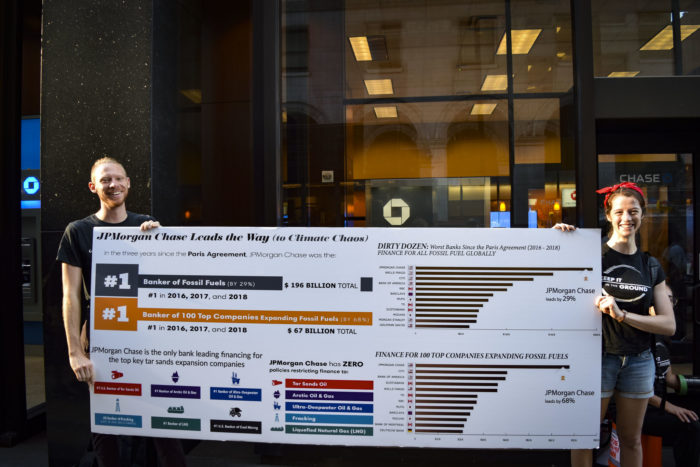

The 2021 Banking on Climate Chaos report, the 12th issue of our annual publication and the most comprehensive analysis of fossil fuel financing to date, reveals this year’s worst offenders. Unsurprisingly, JPMorgan Chase once again earns the unenviable distinction as the largest funder of climate chaos, a title it’s held every year since the 2015 Paris Climate Agreement. In 2020, Chase sunk $51.3 BILLION into fossil fuels. Citi followed close behind, plunging $48.4 billion into coal, gas and oil.

Mitsubishi UFJ Financial Group (MUFG), Japan’s largest bank, didn’t fare much better, pumping $29.1 billion into fossil fuels in 2020. The largest Asian funder of tar sands, MUFG is also a financier of Line 3, an unpopular tar sands pipeline snaking from Alberta, Canada down to Minnesota and Wisconsin through Indigenous territories without the consent of impacted Indigenous Peoples. In a one-two punch to the planet, MUFG also continues to pour money into companies that supply or purchase Conflict Palm Oil, a commodity notorious for human rights abuses and the destruction of tropical rainforests and peatlands.

Banks simply MUST align with the Paris Agreement’s goals of capping global temperature rise at 1.5 degrees Celsius above pre-industrial levels—beyond which, scientists warn of devastating, irreversible consequences. To ensure Chase and MUFG hear our message loud and clear, we’re turning up the volume just in time for their upcoming AGMs.

It’s AGM (Annual General Meeting) season

The Annual General Meetings (AGMs) for Chase and MUFG are coming up in May and June, and we’re ramping up pressure ahead of these gatherings—a space for shareholders to ask questions and hold bank leadership accountable for harmful activities.

During the first week of March, we held a Week of Action targeting Chase offices and branches across the nation, from Seattle and San Francisco to the Twin Cities and NYC. And we have even more activities planned, like our Adopt-an-Executive campaign and postcard-mailing action to Chase and MUFG executives.

Last year, due to COVID, Chase moved its AGM online, but we didn’t let that stop us from making our voices heard. Like every year, we’re prepared. We ran the numbers and did our homework. We’ve made our demands known to bank leadership. And this year, we’ve added another tool to our belt—the Principles we developed for financial institutions to align with the Paris Climate Agreement.

Our demands are simple: adopt the Paris Principles

Our demands to finance giants like Chase, Citi and MUFG are simple—and we provided them with a clear roadmap on how to do it.

Last September, a group of 60 climate and human rights groups led by RAN issued the Principles for Paris-Aligned Financial Institutions, a set of guidelines for financial institutions to align themselves with the goals of the Paris Agreement. The Paris Principles outline the immediate steps needed, such as ending all financing, insurance, and investments into new coal, oil, and gas projects, as well as actions to end financing for the destruction of tropical rainforests. The Principles expand on ways for financial institutions to zero out their climate pollution, and beyond that, the Principles make the necessary case for equity, justice and human rights.

While banks haven’t taken the immediate action needed to match the urgency of climate chaos, it’s important to acknowledge how far we’ve come—and thanks to your support, we squeezed a number of commitments from Chase in 2020!

Slowly, we’re chipping away at Chase

Last October, Chase issued a fuzzy promise to align its business with the goals of the Paris Agreement. While gestures are nice for birthdays and anniversaries, it is frankly not enough to issue vaguely supportive statements when it comes to climate chaos. We need action, and Chase’s latest announcement lacked commitments for ending fossil fuel financing (particularly coal and tar sands), cutting funding for projects driving tropical deforestation, and respecting Indigenous rights.

Still, we’re chipping away at Chase. At its last AGM, shareholders issued a historic warning to Chase leadership, with a whopping 49% voting for a resolution calling on the bank to align its activities with the Paris Agreement. And in February 2020, the financial behemoth announced it would end financing for Arctic oil and gas projects, and implement stricter restrictions for funding coal mining and power.

We’ll keep pressuring banks like Chase, Citi, and MUFG to move past empty words towards REAL actionable change—and we hope you’ll continue with us on this journey for a more just, sustainable world.