This April, nearly 10,000 insurance industry and risk management professionals are gathering in San Francisco for the Risk Management Society’s annual meeting: RISKWORLD 2022. Yet while the conference is focused on risk, it completely fails to address the harms associated with the industry’s role in insuring destructive fossil fuel infrastructure.

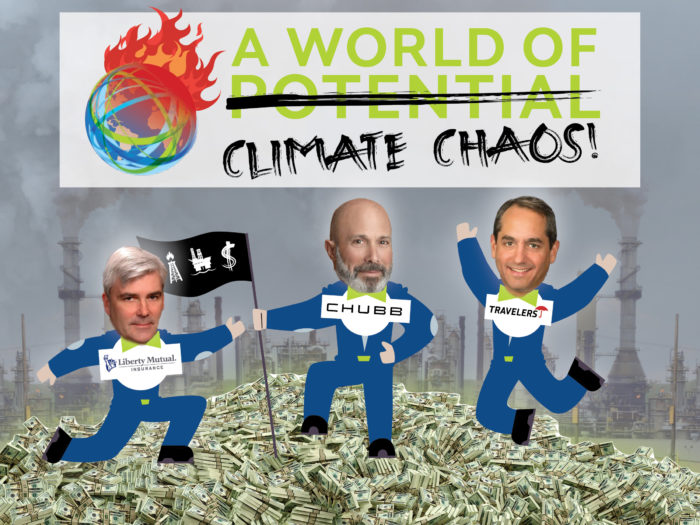

That’s why RAN is teaming up with a coalition of Indigenous rights, environmental justice, and climate organizations to shine a spotlight on the role that the insurance industry plays in enabling fossil fuel projects that pollute communities, violate Indigenous rights, and contribute to the climate crisis. We are here at RISKWORLD 2022 to call on Chubb, Liberty Mutual, Travelers, and the rest of the U.S. insurance industry to stop insuring fossil fuel expansion and respect human rights.

What do insurers have to do with climate change?

Insurance companies are supposed to protect us from catastrophic risks, but in the case of the climate crisis, they are actually fueling it by perpetuating our dependence on dirty fossil fuels. Insurers are driving climate change and harming communities in two fundamental ways:

- Insuring fossil fuel projects and companies: Insurance companies uniquely enable the development and operation of coal, oil, and gas projects by providing insurance coverage. And turns out that U.S. companies make up the largest market share of oil and gas insurance in the world.

- Investing in fossil fuel companies: Insurance companies invest their premiums in fossil fuel companies, enabling even more fossil fuel projects to be built.

The emissions associated with fossil fuel expansion are linked to intensifying wildfires, floods, hurricanes, and deadly heatwaves. Plus, the development of this dangerous infrastructure threatens the drinking water and public health of communities living alongside pipelines, next to refineries, and beyond.

Here in California, the impacts of the climate crisis are being felt acutely, with severe droughts and wildfires devastating communities year after year. Insurance companies are responding by raising insurance costs exorbitantly and abandoning entire communities, while they continue to back increased fossil fuel production. Hypocritical, much?

If you work at an insurance company and would like to explore how you can help advance solutions to climate change or to learn more about the connection between insurance and climate change, we’d like to chat with you.

PLEASE FILL OUT THIS STRICTLY CONFIDENTIAL FORM.

U.S. insurers are lagging behind their peers

While major European and Australian insurers are taking ambitious steps to curb insurance support for coal, oil, and gas, the US insurance industry is undermining global efforts to tackle climate change. To date, more than 30 companies have adopted restrictions on insuring new coal projects, and eight companies, including some of the biggest insurers and reinsurers in the world, have committed to end or restrict underwriting for new oil and gas projects.

By contrast, U.S. insurers like Chubb, The Hartford, Liberty Mutual, and Travelers are lagging far behind their global peers, with just piecemeal restrictions on coal and tar sands business. Liberty Mutual doesn’t even restrict support for the toxic tar sands sector.

We are calling on U.S. insurers to play a leading role in accelerating a just energy transition by adopting the following policies:

- Immediately stop insuring any new fossil fuel projects;

- Phase-out insurance coverage for coal, oil, and gas companies in line with a credible 1.5ºC pathway;

- Adopt policies to ensure that any project they insure has obtained the Free, Prior, and Informed Consent of impacted Indigenous communities.

From the tar sands sector in Canada to offshore drilling in Brazil and the Arctic, the U.S. insurance sector continues to prop up harmful dirty energy infrastructure.

Insurers must rule out Arctic drilling

As one example: oil and gas drilling in the Arctic Refuge threatens the health, subsistence and culture of Indigenous peoples who have stewarded the land since time immemorial and who continue to hold the land sacred. Iñupiat community members oppose oil and gas development on the coastal plain of the Arctic Refuge, as does the Gwich’in Nation.

Without insurance, companies cannot drill for oil and gas in the Arctic – or anywhere else. Insurance is required by law for oil projects conducted through federal and state government leases, and these high-risk projects in the Arctic oil exploration pose risks of spills, worker injury, landscape damage, and more.

In November 2020, the Gwich’in Steering Committee and allies sent a letter to insurance companies asking that they pledge to not insure oil and gas development projects in the Arctic Refuge. To date, 12 insurers have strong policies that clearly rule out insuring oil and gas in the Refuge, and 4 others have policies but with some key loopholes.

Of U.S. insurers, only AIG has a policy restricting insurance for Arctic oil and gas drilling. Chubb, The Hartford, Liberty Mutual, and Travelers have refused to meet with the Gwich’in Steering Committee and discuss their potential support for Arctic drilling – and have zero restrictions in place when it comes to insuring these destructive projects.

A growing movement is demanding action

Communities impacted by fossil fuel projects, youth climate activists, prospective and current insurance employees, and shareholders are increasingly spotlighting insurers’ fossil fuel business and demanding action.

This year, major U.S. insurers are facing a broad challenge from shareholders in the fossil fuel business for the first time ever. Investors have filed shareholder resolutions with Chubb, The Hartford, and Travelers, calling on the insurers to stop underwriting all new fossil fuel supply projects, in line with the International Energy Agency’s (IEA) net zero roadmaps. These resolutions will be up for a vote at their annual meetings this May.

Insurers have a responsibility to help accelerate a just energy transition, not lock us into a fossil-fueled future. Whether you are an employee at a U.S. insurer, a broker, a risk manager, or a concerned activist, there is a role for you to play in pushing the insurance industry to insure our future, not fossil fuels. #InsureOurFuture

SIGN UP TO GET UPDATES FROM RAN’S INSURANCE CAMPAIGN