The Coal Test: Where Big Banks Stand on Climate at COP 21, a new report from Rainforest Action Network, BankTrack, Friends of the Earth-France, and urgewald, analyzes coal policy strengths and weaknesses and highlights where noncommittal banks fall short. With the world convened at the U.N. climate negotiations in Paris (COP 21), bank laggards must surpass their industry peers in terms of responsible climate commitments.

» DOWNLOAD FULL REPORT (PDF) «

Key Takeaways

-

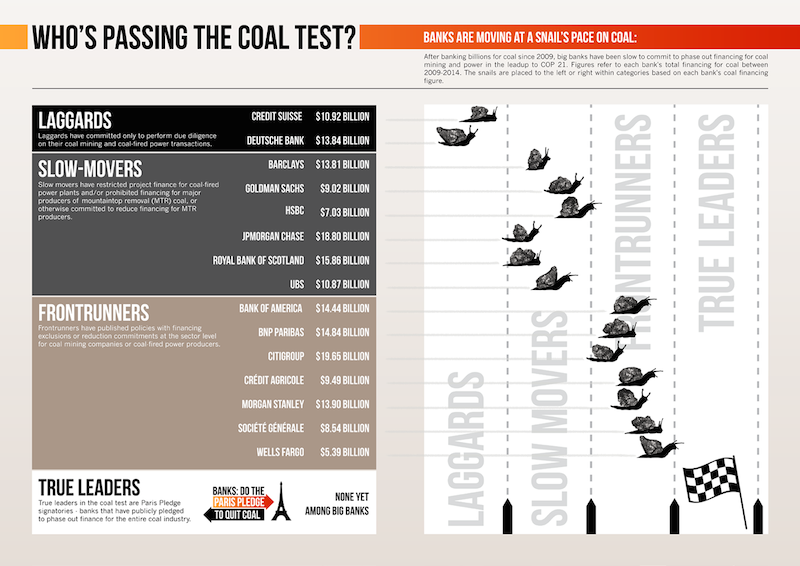

The biggest banks in the U.S. and Europe are also the world’s biggest coal banks. The top ten backers of coal among major global banks are all based in France, Germany, Switzerland, the UK, or the US. The top five coal-financing banks since COP 15 in Copenhagen are Citigroup ($19.65 billion), JPMorgan Chase ($18.80 billion), Royal Bank of Scotland ($15.86 billion), BNP Paribas ($14.84 billion), and Bank of America ($14.44 billion).

-

Between Copenhagen and Paris, big banks have supported this carbon-intensive fuel with $257 billion. Between 2009, the year of the Copenhagen climate summit, and 2014, the world’s biggest banks put only 40 percent as much financing into the entire renewable energy sector ($104.59 billion) as into coal alone ($257.02 billion).

-

The world’s largest financial institutions are setting new benchmarks as they make commitments to cut financing for coal. In response to growing pressure from the global climate movement, since May 2015, Bank of America, Credit Agricole, Natixis, Citigroup, Goldman Sachs, Société Générale, BNP Paribas, Morgan Stanley and Wells Fargo have each announced new policies on coal financing.

» DOWNLOAD FULL REPORT (PDF) «

Click for full-sized infographic:

» DOWNLOAD FULL REPORT (PDF) «