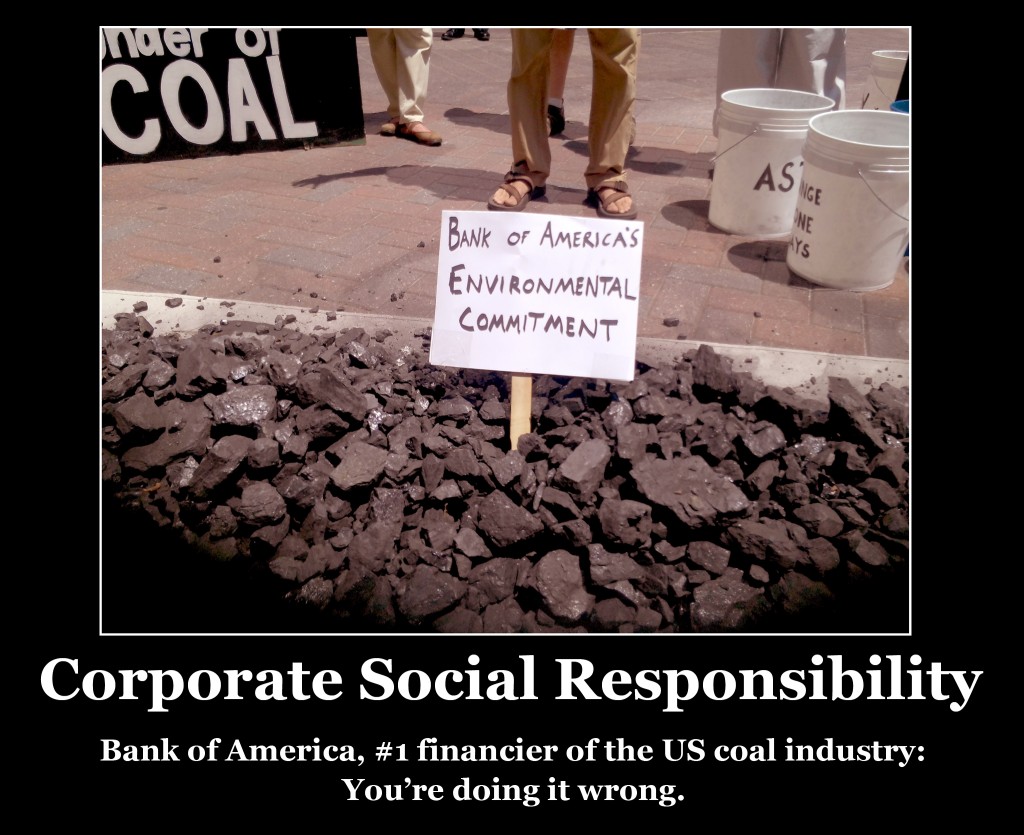

This morning Bank of America rolled out its annual Corporate Social Responsibility (CSR) report, which proudly promotes the company’s commitment to greening their public image but fails to address its biggest environmental impact: financing the coal industry.

Bank of America wants to have it both ways: The bank wants to appear as a responsible corporate actor, but still benefit from destructive coal mining and coal-fired utilities. Its CSR report reeks of hypocrisy as it profits at the expense of communities and our environment while also identifying itself as a climate champion.

Bank of America claims to be “working to finance the transition to a lower-carbon future”, yet commitments to renewable energy and energy efficiency only make progress towards greening its own image. To stem the impending climate crisis, however, the burning of coal must be phased out of the U.S. energy grid.

According to its CSR report, Bank of America acknowledges the impact of these investments by reporting on emissions of utilities in its lending portfolio. However, the bank’s reporting methodology is flawed and non-transparent. As it has in the past, the bank only reports on emissions from 75% of its utility portfolio, providing an incomplete assessment of emissions associated with the bank’s lending activities. Without full disclosure, it remains unclear whether the bank is actually shifting its lending away from the most coal-intensive utilities or whether the bank’s lending practices have lagged a national shift away from coal-fired power generation and towards cleaner alternatives.

Bank of America’s Environmental Business Initiative, while a step in the right direction, is insufficient to offset the environmental damage caused by its lending practices. The $3.65 billion lending component of BofA’s 2011 commitment represents less than half a percent of the bank’s total loans and leases as of December 2011 ($926 billion). In contrast, the bank charged off more than five times as much in bad debt during 2011 ($20.8 billion). Were the bank to offset the emissions from its utility portfolio in 2011, we estimate that the cost would far exceed this $3.65 billion amount.

This report fails to address Bank of America’s position as the number one underwriter of the coal mining industry or report plans for reducing fossil fuel investments. In fact, the record shows increases in spending. In 2010 and 2011, Bank of America provided $6.4 billion in underwriting for U.S. coal.

Bank of America has its hands in a dirty business, where the drive for profit outweighs consequences like human and environmental catastrophes associated with climate change. The bank is the largest financier of the coal industry in the U.S., and funds every stage of coal’s life cycle. It spends billions each year underwriting destructive mountaintop removal mining and utilities that operate coal-burning power plants.

It’s time for Bank of America to phase out funding for the coal industry. The impacts on the climate and public health make it a dangerous investment. Bank of America’s best course forward would be to end its investment in fossil fuels.

Check out this video of people who traveled to Bank of America’s annual shareholder meeting to explain to the bank the impacts of its financing of the coal industry in their communities:

[youtube TsMB2CuP3zM 550]