“Most innovative investment bank for climate change.” – Citigroup

“Mak(ing) your life greener and help(ing) tackle climate change.” – Morgan Stanley

“Financing a low carbon economy.” – Bank of America

When banks tout slogans such as these, you might expect them to mean that they plan to phase out financing for coal, the single largest source of global climate emissions. Unfortunately, these and other banks are doing the opposite, as a new report from the BankTrack network and RAN found. Since 2005, the year the Kyoto Protocol came into force, bank financing for coal mining companies increased by 397 percent.

This surge in bank financing for coal is not just hypocritical, it’s also insane: Leading scientific, policy, and civil society institutions around the world have concluded that burning more than 20% of existing global coal reserves would lock in catastrophic climate change.

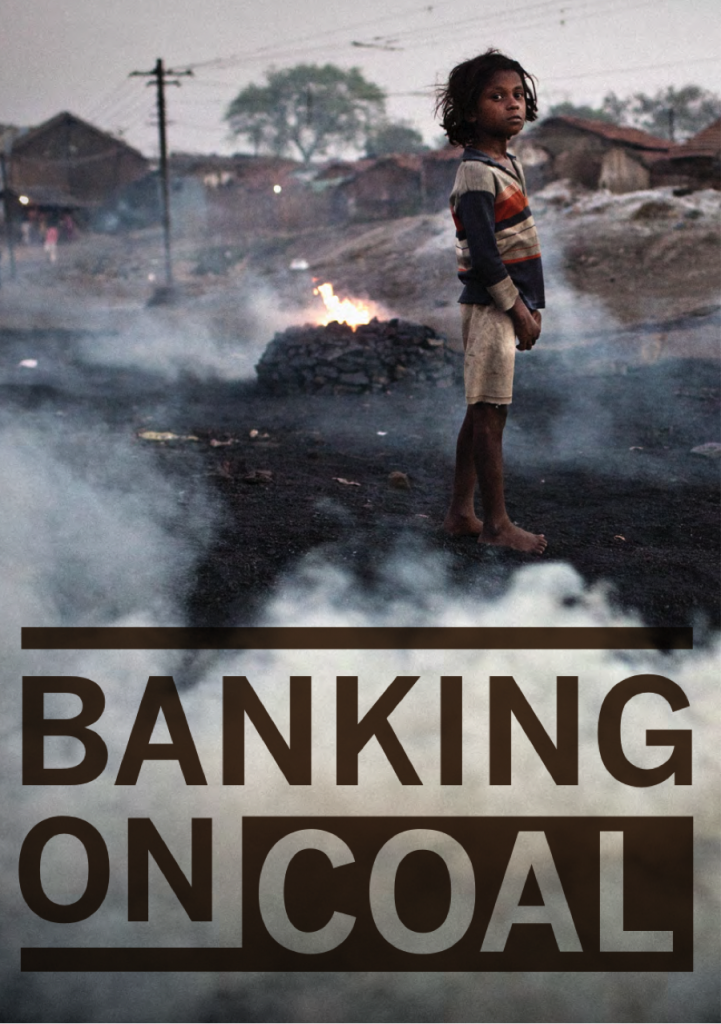

The BankTrack report, entitled “Banking on Coal,” was released at the COP 19 climate conference in Warsaw, Poland and also found that global coal production has grown by 69 percent since 2000 and has now reached 7.9 billion tons annually.

The future of coal was a front-and-center issue at COP 19 and at a simultaneous coal industry conference held in Warsaw this month. In a speech at the World Coal Conference, Christiana Figueres, the chair of the UN Framework Convention on Climate Change, told attendees that any responsible future for the global coal industry must involve “leav(ing) most existing reserves in the ground.”

The finance industry has played a key role in the recent global coal boom: In the past eight years, 89 commercial banks provided $158 billion in financing to the world’s largest and most destructive mining companies. Citigroup, Morgan Stanley, and Bank of America—the very same banks that mouth the sustainability slogans mentioned above—topped the list of coal-financing banks, providing $9.76 billion, $9.69 billion, and $8.79 billion, respectively.

The report also highlights coal production “hot spots” on six continents where coal extraction has had especially devastating impacts on communities, ecosystems, or human health. Building on research from BankTrack member organizations around the globe, the report highlights the destructive impacts that coal mining is having on India’s last tiger forests, on Appalachian communities in the U.S., and on scarce water resources in South Africa.

Banks are not alone in their climate hypocrisy. For example, the Government of Poland touted its commitment to powering the country with coal even as it played host to the COP 19 climate conference. But despite stiff competition from governments of Poland and other emissions-intensive countries, the degree to which major global banks are complicit in the worst coal mining projects around the world is staggering.

Fortunately, bank hypocrisy on coal doesn’t work like it used to. Students certainly aren’t fooled, as campus groups across the U.S. have disrupted over 50 Bank of America and Citigroup recruitment sessions this fall over the leading role these banks play in financing the coal industry. Globally, the climate movement is becoming stronger by the day and has attracted growing support from within the financial industry, leaving the banks highlighted in the report increasingly isolated in their support for a coal-fired future.